FASB Issues Change In Effective Date Philosophy And Delay In Effective Dates Of Four ASUs For Certai

FASB Issues Change In Effective Date Philosophy And Delay In Effective Dates Of Four ASUs For Certai

The FASB recently approved delays of the effective dates for several of its recent standards that provide at least an additional year to companies that have not yet adopted the standards in ASU 2019-09, Financial Services – Insurance (Topic 944): Effective Date and ASU 2019-10, Financial Instruments – Credit Losses (Topic 326), Derivatives and Hedging (Topic 815), and Leases (Topic 842): Effective Dates. The deferral of implementation is a result of outreach with stakeholders and monitoring of implementation.

The FASB has gained a better understanding of the implementation challenges encountered by all types of entities when adopting a major ASU, which are often magnified for private companies, smaller public companies, and not-for-profit organizations. Challenges can include:

- Availability of external and internal resources

- Timing and sources of education

- Knowledge or experience gained from implementation issues by larger public companies

- Comprehensive transition requirements

- Understanding and applying guidance from post-issuance standard-setting activities

- Development or acquisition of sufficient information technology and expertise in developing new systems or effecting systems changes

- Development or acquisition of effective business solutions and internal controls

- Development or acquisition of better data or estimation processes

Public business entities include those that file or furnish financial statements with or to the SEC, including employee benefit plans and not-for-profit entities that have issued or are conduit bond obligors for securities traded, listed or quoted on an exchange or over-the-counter market. Smaller reporting companies (SRCs) are SEC filers with a public float of less than $250 million, or annual revenue of less than $100 million and either no public float or a public float of less than $700 million.

For existing major ASUs not yet effective, determining whether an entity is eligible to be a SRC will be based on the most recent SRC determination in accordance with SEC regulations as of November 15, 2019. For calendar-year-end entities, this date will be June 28, 2019. For future major ASUs, the determination will be based on the entity’s most recent SRC determination in accordance with SEC regulations.

With this updated philosophy, a major ASU would first be effective for bucket-one entities. Bucket-two entities would be anticipated to have an effective date staggered at least two years after bucket-one entities for major ASUs. Generally, it is anticipated that early adoption would be permitted.

The FASB has approved that this updated philosophy be applied to the effective dates for the following major ASUs, including amendments issued after issuance of the original ASU:

- ASU 2016-02, Leases (Topic 842) (Leases)

- ASU 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (Credit Losses)

- ASU 2017-02, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities (Hedging)

- ASU 2018-12, Financial Services – Insurance (Topic 944): Targeted Improvements to the Accounting for Long-Duration Contracts (Insurance)

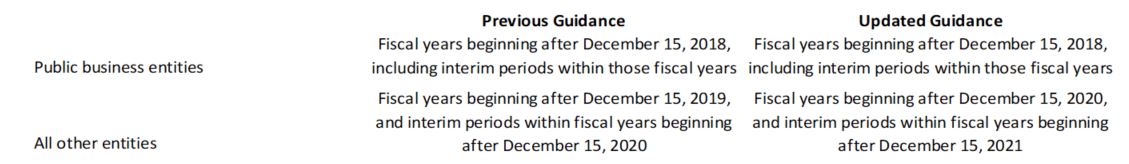

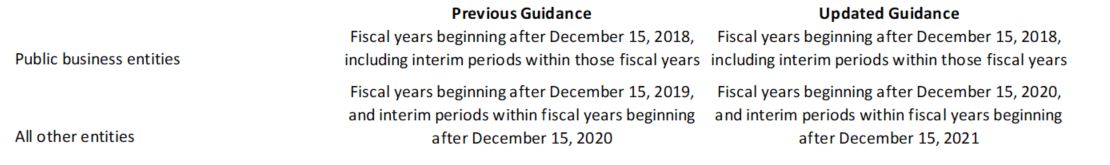

Leases currently is effective for some entities. Because Leases is already effective for all public business entities including SRCs, not-for-profit entities that have issued or are conduit bond obligors for securities that are traded, listed or quoted on an exchange or an over-the-counter market, and employee benefit plans that file or furnish financial statements with or to the SEC, the FASB retained the effective date for those entities. Early adoption is allowed. Mandatory effective dates under the ASU are as follow:

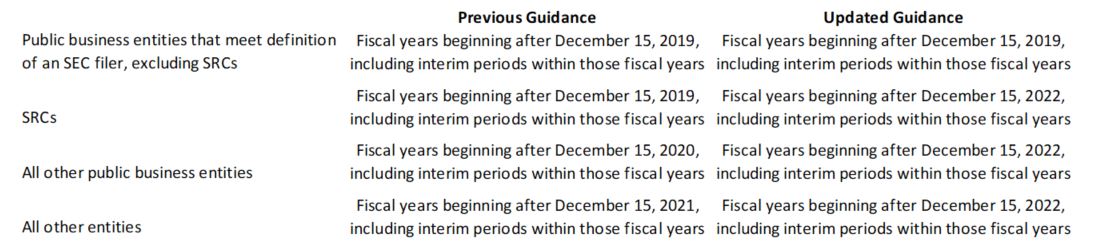

Credit Losses currently is not effective for any entities, but early application is permitted for fiscal years beginning after December 15, 2018. Mandatory effective dates under the ASU are as follow:

Additionally, the ASU amends the mandatory effective date of ASU 2017-04, Intangibles – Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment in order to align the effect date related to Credit Losses with the goodwill impairment test simplification. Early adoption is still allowed.

Hedging currently is effective for some entities. Because Hedging is already effective for all public business entities, the FASB retained the effective date for those entities, including SRCs. Early adoption is allowed. Mandatory effective dates under the ASU are as follow:

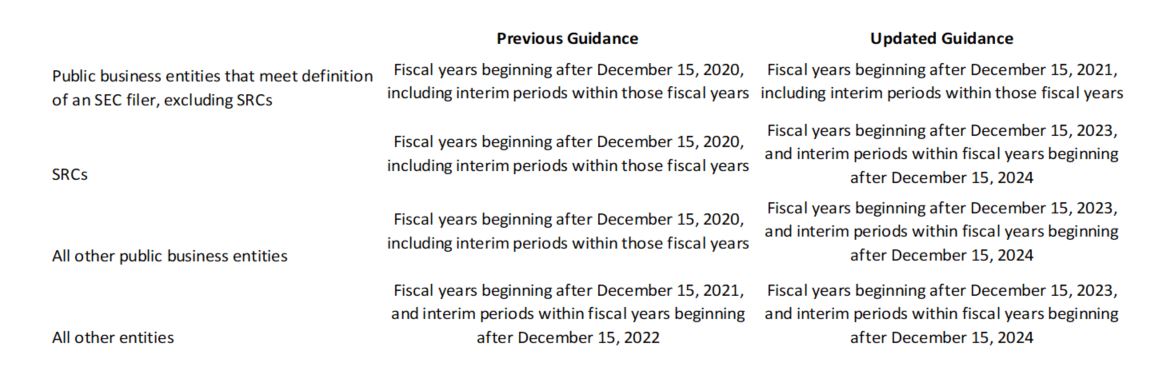

Insurance currently is not effective for any entities, but early application is permitted. Mandatory effective dates under the ASU are as follow:

Readers should not act upon information presented without individual professional consultation.