Focus on Healthcare: Provider Relief Fund Update- 60-Day Reporting Grace Period, New Round of Funding

Focus on Healthcare: Provider Relief Fund Update- 60-Day Reporting Grace Period, New Round of Funding

As previously communicated, healthcare providers who received more than $10,000 of Provider Relief Fund (PRF) payments from the department of Health and Human Services (HHS) on or before June 30, 2020, are required to report on their use of the funds by September 30, 2021.

Although the September 30th deadline has not technically changed, HHS is providing a 60-day grace period to complete the reporting and return any unused funds. While you will be out of compliance if you do not submit your report by September 30, 2021, recoupment or other enforcement actions will not be initiated during a 60-day grace period (October 1 – November 30, 2021).

Providers should return unused funds as soon as possible after submitting their report. All unused funds must be returned no later than 30 days after the end of the grace period (December 30, 2021).

The grace period only applies to the reporting deadline. There is no change in the deadline to use the funds, which was June 30, 2021.

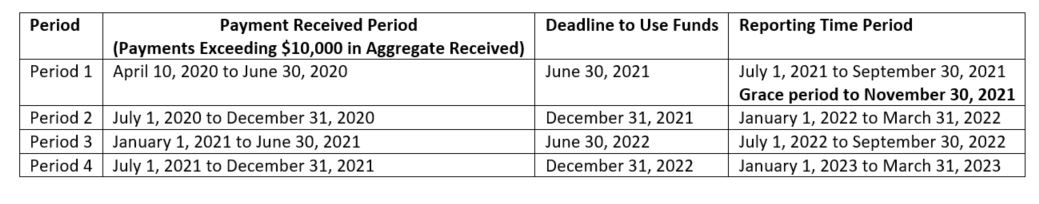

The table below summarizes the relevant deadlines for PRF payments:

Phase 4 and Rural Health Funding Announced

On September 29, 2021, healthcare providers will be able to apply for $25.5 billion in relief funds, including $8.5 billion in American Rescue Plan (ARP) resources for providers who serve rural patients and $17 billion for Provider Relief Fund (PRF) Phase 4 for a broad range of providers who can document revenue loss and expenses associated with the pandemic.

In order to streamline the application process and minimize administrative burdens, providers will apply for both programs in a single application and HRSA (Health Resources and Services Administration) will use existing Medicaid/CHIP and Medicare claims data in calculating portions of these payments.

- Phase 4 General Distribution — $17 billion based on providers’ lost revenues and changes in operating expenses from July 1, 2020 to March 31, 2021.

- To promote equity and to support providers with the most need, HRSA will:

-

- Reimburse a higher percentage of lost revenues and expenses for smaller providers as compared to larger providers.

- Provide "bonus" payments based on the amount of services they provide to Medicaid, CHIP, and Medicare patients, priced at the generally higher Medicare rates.

-

- To promote equity and to support providers with the most need, HRSA will:

- American Rescue Plan (ARP) Rural — $8.5 billion based on the amount of services providers furnish to Medicaid/CHIP and Medicare beneficiaries living in Federal Office of Rural Health Policy (FORHP)-defined rural areas.

- To promote equity, HRSA will price payments at the generally higher Medicare rates for Medicaid/CHIP patients.

We will provide further details as they become available.

For more information, follow these links:

PRF Phase 4 and Rural Distribution Announcement

PRF Reporting Requirements June 11, 2021

PRF Frequently Asked Questions

Readers should not act upon information presented without individual professional consultation.

Any federal tax advice contained in this communication (including any attachments): (i) is intended for your use only; (ii) is based on the accuracy and completeness of the facts you have provided us; and (iii) may not be relied upon to avoid penalties.