Focus on Public Sector, Not-For-Profit, Colleges and Universities: 2020 OMB Compliance Supplement Addendum

Focus on Public Sector, Not-For-Profit, Colleges and Universities: 2020 OMB Compliance Supplement Addendum

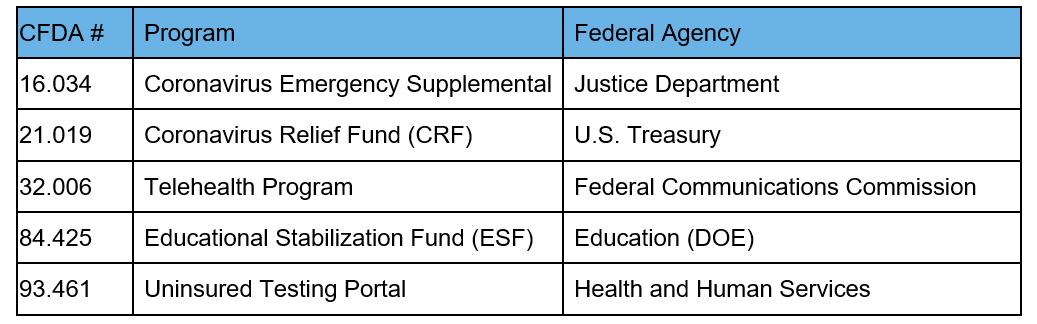

As a reminder, subsequent to the onset of the pandemic, the CARES Act funded at least 20 new, major federal programs in response to the pandemic. The following significant CARES Act funded programs are included in the Addendum:

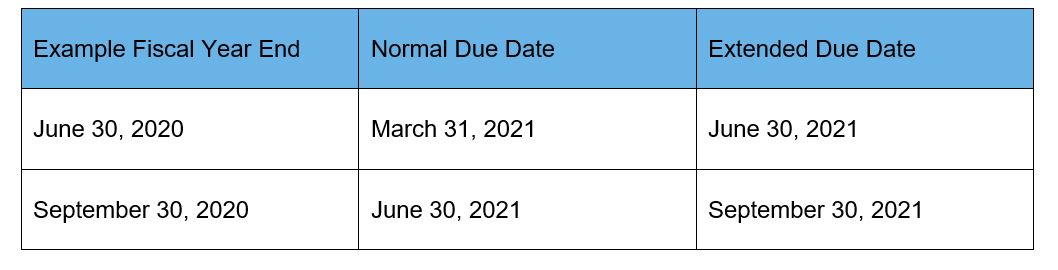

The most notable update in the Addendum will allow recipients and subrecipients that received COVID-19 funding with original Federal Audit Clearinghouse Submission due dates from October 1, 2020 through June 30, 2021 to take advantage of a 3-month extension and still be considered a low-risk auditee. This extension does not require individual recipients and subrecipients to seek approval; however, documentation should be maintained by the recipients and subrecipients as to the reason for the delayed filing. The extension does not apply to organizations that did not receive COVID-19 funding.

Another key update in the Addendum is the fact that Provider Relief Fund (PRF) expenditures and lost revenues will not be included on Schedules of Expenditures of Federal Awards (SEFAs) until December 31, 2020 year-ends and later. Recipients with year-ends prior to December 31, 2020 will report the 2020 PRF expenditures on their subsequent year’s SEFA. The Department of Health and Human Services (HHS) says this will allow the reporting of PRF funds on the SEFA to link directly to the amounts required to be reported to HHS for the same time period. Consequently, this could result in accounting differences for PRF funds in the financial statements versus the SEFA.

The Addendum also added a new reporting requirement related to the Federal Funding Accountability and Transparency Act (FFATA). FFATA requires direct recipients of grants who make first-tier subawards of $25,000 or more to report subaward data through the FFATA Subaward Reporting System. Initially, FFATA requirements will only apply to COVID-19 programs but will be extended to all major programs, regardless of whether COVID-19 funding is involved, for single audits of fiscal year ends after September 30, 2020. The CRF program is not subject to FFATA reporting based on Treasury OIG Reporting Guidance (FAQ 31).

Lastly, the Addendum discusses a stand-alone footnote requirement to the notes to the SEFA, which requires an organization to disclose the fair market value of donated Personal Protective Equipment (PPE) at the time of receipt if the PPE was originally purchased with federal funding. The donated PPE should not be counted by the auditor for purposes of determining the threshold for a single audit, determining the type A/B program threshold for major programs, and is not required to be audited as a major program.

A few other reminders that were included in Appendix VII, Other Audit Advisories, of the first release in August 2020:

- When COVID-19 funds are subawarded from an existing program, the information furnished to subrecipients should distinguish the subawards of incremental COVID-19 funds from non-COVID-19 subawards under the existing program

- The SEFA must identify COVID-19 funds on a line separate from non-COVID-19 funds by using “COVID-19” as a prefix to the program name

RubinBrown is holding a webinar on January 21, 2021 to provide our clients and contacts with the latest updates on the Office of Management and Budget (OMB) Compliance Supplement Addendum.

Click here to access the full 2020 Compliance Supplement Addendum, as well as the first release of the 2020 Compliance Supplement.

Readers should not act upon information presented without individual professional consultation.

Any federal tax advice contained in this communication (including any attachments): (i) is intended for your use only; (ii) is based on the accuracy and completeness of the facts you have provided us; and (iii) may not be relied upon to avoid penalties.