Missouri Qualified Research Expense Tax Credit Guidance

Missouri Qualified Research Expense Tax Credit Guidance

Executive Summary

The Missouri Qualified Research Expense Tax Credit is a program designed to encourage research and development within Missouri. Recently released program guidance provides information on the application process and further program details. Key takeaways include:

- The credit is equal to 15% of “additional qualified research expenses,” or 20% if the research is conducted in conjunction with a Missouri-based college or university.

- The credit is available from January 1, 2023, through December 31, 2028.

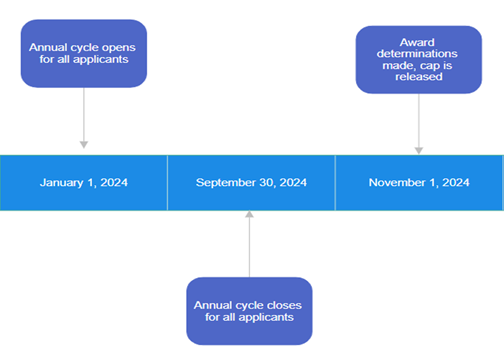

- The application cycle runs on an annual basis, opening on January 1, and closing on September 30, with award determinations made on November 1 for that year’s application. An application covers eligible expenses in the prior tax year (the 2024 application cycle covers 2023 eligible expenses).

- Qualified applicants include individuals, partnerships, certain corporations, and charitable organizations exempt from federal income tax and whose Missouri unrelated business taxable income, if any, would be subject to state income tax,

- No single taxpayer may be issued more than $300,000 in credits per calendar year and there is an annual program cap of $10 million for all credits issued in any calendar year. $5 million of the program cap is reserved for Minority Business Enterprises, Women’s Business Enterprises, and small businesses.

- If all projects cannot be fully funded, applicants will receive a prorated credit, based on qualifying expenses.

- There is a 2.5% application fee associated with the credit.

- Unused credits can carry forward for up to 12 years.

Background

The Missouri Qualified Research Expense Tax Credit was enacted to encourage companies to conduct research and development in the state of Missouri. This credit, which has not been available since 2004, is currently available from January 1, 2023 through December 31, 2028. Applications for 2023-related expenses are now being accepted.

Research Credit Calculation

The credit is equal to 15 percent of “additional qualified research expenses,” or 20 percent of these research expenses if conducted in conjunction with a public or private college or university located in Missouri. “Additional qualified research expenses” are defined as the difference between qualified research expenses incurred in a tax year subtracted by the average of the taxpayer’s qualified research expenses incurred in the three immediately preceding tax years. All applicants must have Missouri qualified research expenses in at least one of the three years preceding the year covered by the application.

Application Process

The annual application cycle for the credit opens on January 1, and closes on September 30. On November 1, award determinations will be made and the program cap released. An application covers eligible expenses in the prior tax year (i.e., the 2024 application cycle covers 2023 eligible expenses).

Qualified applicants include individuals, partnerships, certain corporations, or a charitable organization which is exempt from federal income tax and whose Missouri unrelated business taxable income, if any, would be subject to state income tax.

Applicants are required to submit the following documentation, and are encouraged to gather the information prior to beginning the application process:

- Federal Employer Identification Number (FEIN)

- MO Tax ID Number

- Form 6765, Credit for Increasing Research Activities

- Certificate of Good Standing or Business’ Listing on the Missouri Secretary of State’s Business Portal

- E-Verify Registration and MOU

- Leadership and Ownership Information

- Eligibility as a MBE/WBE (if applicable)

- Eligibility as a small business (if applicable)

- Eligibility as a new business (if applicable)

- Documentation for research conducted in conjunction with public or private college or university (only required for 20% tax credits applicants)

- Certificate of State of Missouri Tax Clearance

Disbursements

Credits are limited to $300,000 per taxpayer per calendar year, with an annual program cap of $10 million.

The first $5 million of the program cap is reserved for Minority Business Enterprises, Women’s Business Enterprises, and small businesses, and is referred to as the “special cap.” The Missouri Department of Economic Development defines small businesses as having fifty or fewer full-time employees.

If total eligible applicants’ credits exceed the special cap, eligible applicants that are considered “new businesses” (a business less than five years old) will be fully funded on a first-come-first-serve basis. If a special cap balance exists after disbursements, the balance is rolled into the remaining program cap, referred to as the “general cap.” If there are remaining applicants that qualify for the special cap after disbursements, Minority Business Enterprises, Women’s Business Enterprises, and small businesses will be fully funded, with the remaining eligible applicants receiving the credit on a pro-rata basis.

If all projects cannot be fully funded, applicants will receive a prorated credit, based on qualifying expenses. The pro-rata credit is calculated by taking the percentage of eligible tax credit and multiplying by each taxpayer’s eligible credit amount, resulting in the prorated amount of tax credit that will be authorized and issued to eligible applicants.

Award Details

A credit is issued after a program application fee equal to 2.5 percent of the credit is paid.

Up to 100 percent of the tax credits are transferable and may be sold or assigned by filing a notarized endorsement with the Department of Economic Development that provides details on the transfer. Both parties must complete Missouri Form MO-TF.

To claim the credits, recipients will enter the amount of the tax credit on Missouri Form MO-TC and on the appropriate line of the state tax return. Unused credits can be carried for up to twelve years.

Please reach out to your RubinBrown advisor for additional information on how to take advantage of this credit.

Related: RubinBrown Focus on Taxation: Missouri Enacts Qualified Research Expense Tax CreditPublished: 01/25/2024

Readers should not act upon information presented without individual professional consultation.

Any federal tax advice contained in this communication (including any attachments): (i) is intended for your use only; (ii) is based on the accuracy and completeness of the facts you have provided us; and (iii) may not be relied upon to avoid penalties.