RubinBrown Sports Betting Index: April 2024 Analysis

RubinBrown Sports Betting Index: April 2024 Analysis

April Sports Betting Index (SBI)

LEARN MORE ABOUT THE RUBINBROWN SBI

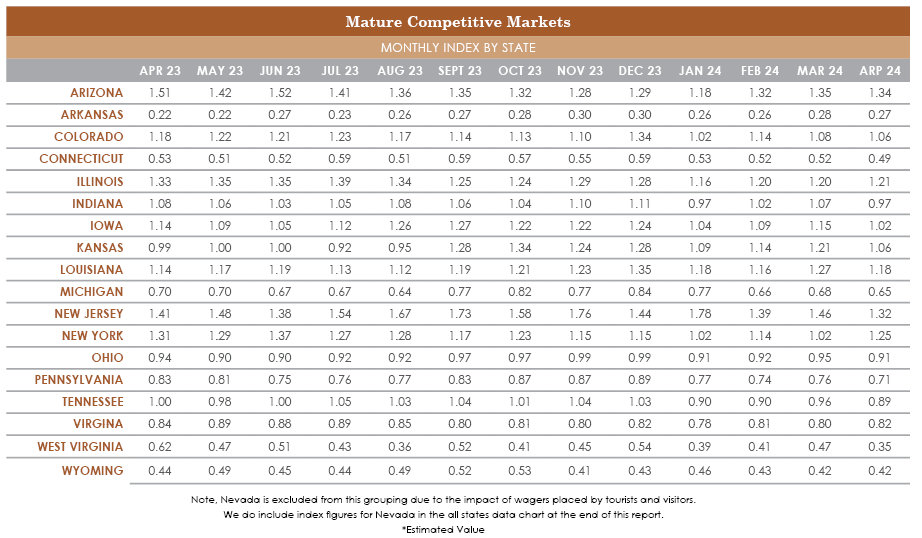

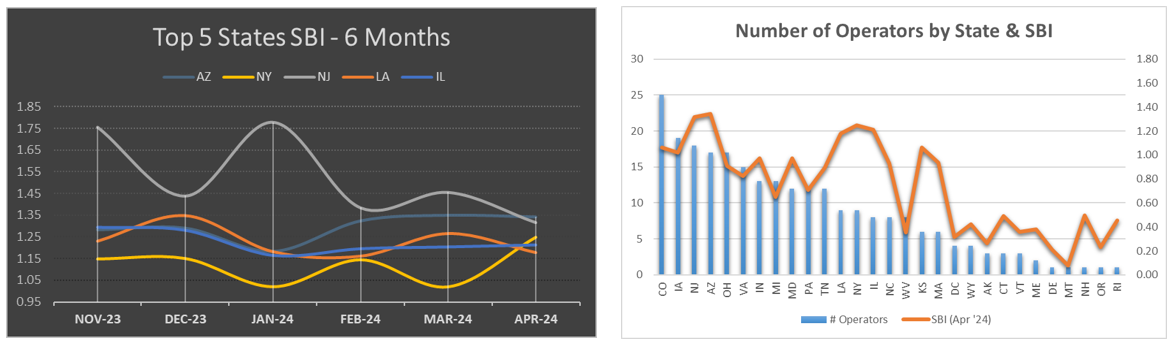

April sports betting handles in our universe of mature and competitive states were down from March following typical seasonality as NCAA basketball tournaments consistently drive a spike in handle that makes for the strongest non-football month of the betting calendar.

However, the RubinBrown Sports Betting Index Benchmark, the proprietary tool by which we measure individual state performance, showed an increase of 18.5% when comparing April 2024 to April 2023. This is lower than the handle increase of 24.4% across our universe of mature competitive markets but still reflects strong overall market growth. The significance of this number is that it reflects organic growth from mature markets as opposed to temporary growth from new markets.

This bodes well for a stronger “offseason” of sports betting to come in the typically slower months until August.

April’s handle might also point to the growth of betting on women’s basketball. The betting calendar for April ’24 saw 2 additional NCAA women’s tournament games compared to last year, including the Iowa-LSU game which was watched by an estimated 12 million viewers. The additional games and the highly anticipated opening of the WNBA season with Caitlin Clark’s debut likely were a key part of the increased handle seen nationwide. Continued growth of interest in the WNBA and a strong start to baseball season, as commented on by the major sports betting operators, brings hope that we will see year over year increases in what is normally a very slow time of year for sports betting.

Sports betting tax rates have been a focus in the recent weeks as Illinois revised their rates from a flat 15% to a tiered system beginning at 20% with top rates as high as 40%. The concern amongst the industry is that other states will soon follow suit with the unintended consequences of either squeezing out smaller operators, or having these taxes trickle down into the pricing.

As we track handle, not revenue, with our SBI, we suspect there will be little change in our numbers due to increased taxes. Operators may adjust their pricing and offerings to generate higher holds in response but we do not see tax increases impacting demand from patrons. If the concerns of many in the industry come true and this leads to other states following suit, we anticipate operators will change their strategic approach.

We look forward to further discussions with operators and their vendors about the direction of the Sports Betting industry. At RubinBrown, our strategic optimization and consulting efforts aim to assist gaming companies in refining their product offerings and growth strategies, helping them achieve greater efficiencies in this highly regulated and taxed industry.

Published: 06/28/2024

Readers should not act upon information presented without individual professional consultation.

Any federal tax advice contained in this communication (including any attachments): (i) is intended for your use only; (ii) is based on the accuracy and completeness of the facts you have provided us; and (iii) may not be relied upon to avoid penalties.