RubinBrown Sports Betting Index: February 2024 Analysis

RubinBrown Sports Betting Index: February 2024 Analysis

February Sports Betting Index (SBI)

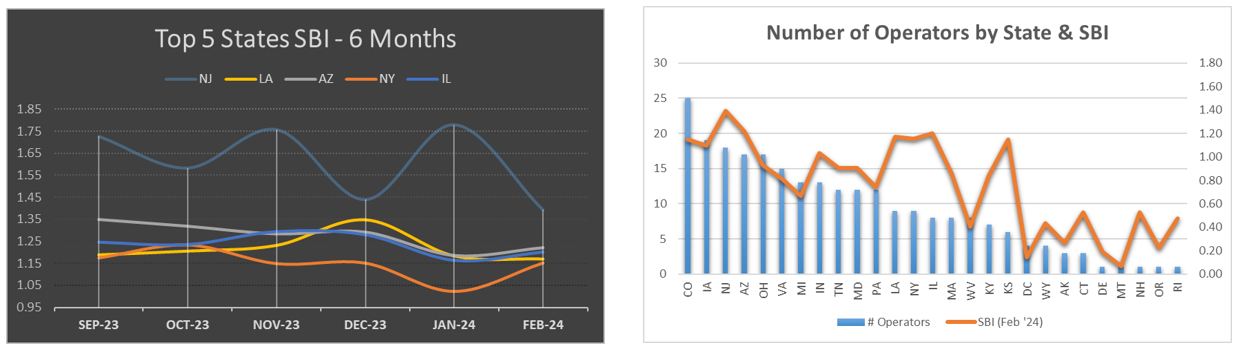

In the chart below, we present our RubinBrown Sports Betting Index (SBI). The SBI is based on our proprietary index of the leading sports betting states in the U.S. To continue to best reflect current market conditions, we’ll occasionally adjust the components of the index. To better compare competitive conditions, our index numbers focus in on a group of mature, competitive states. Therefore, a state with an index score of 1.15 had a raw index score of 15% greater than the average, while a 0.90 index score shows a 10% lower than average result.

LEARN MORE ABOUT THE RUBINBROWN SBI

The completion of February’s Super Bowl officially brings the NFL betting season to a close. As the largest single betting event of the year, the Super Bowl’s impact on monthly totals is significant. In Nevada alone, a record $185.6 million was bet on the game, surpassing their previous record set just last year at $179.8 million. Being host to the Super Bowl certainly helped Nevada’s monthly totals. The 8.6% increase in YoY handle bucked a trend of three consecutive monthly YoY declines.

While the increase may seem promising, Nevada’s 8.6% bump compares poorly to the aggregate performance of our Mature/Competitive States, who posted a 17.27% gain over the same period.

The magnitude of the Super Bowl’s impact on the host state’s sports betting is still in question. We hope to get a clearer picture in February 2025 when the game will be played in Louisiana, a state with a mature and competitive sports betting market. In the recent past, with the game being hosted by 2 non-betting states (California and Florida), a state in the ramp-up phase of sports betting (Arizona), and a tourism dominated state in the midst of a market decline (Nevada), current data is still anecdotal.

February also saw a return to normalcy for New Jersey’s sports betting handle. After a blistering $1.7 billion January, the Garden State took a breather and clocked in at just over $1.08 billion, which is their lowest total since August 2023. This result barely held their usual national 2nd place position for the month as Illinois’ $1.07 billion nearly took away this runner up status. When compared to February of 2023, however, this year’s NJ handle still represents a hefty 27.59% growth for the state. The rumored increased attention to VIP marketing activity occurring with the Meadowlands’ Fanatics skin, which caused the January spike, did not repeat itself in February. However, looking forward to March, we do see similar activity taking place.

.png?lang=en-US)

In terms of industry seasonality, February ushered in the expected downturn in overall handle from January as each of our Mature Competitive States saw a decrease in handle versus the prior month’s totals. But following New Jersey’s lead, the chart below demonstrates healthy growth in year-over-year comparisons for most of these states, with a 17.27% overall increase. While at the time of this writing Arizona had yet to report February data, we have estimated small decline in YoY due to an inflated 2023 February total when the Grand Canyon state hosted Super Bowl LVII.

.png?lang=en-US)

We expect continued consolidation via market exits and M&A activity, along with an increased focus on regulatory concerns such as compliance, transparency in reporting and responsible gaming initiatives. During these pivotal market shifts, it is imperative for all stakeholders to seek guidance from experienced industry experts. At RubinBrown, our team is primed and enthusiastic to offer tailored support and expertise to navigate the next stage in the evolution of the sports betting market.

Published: 04/26/2024

Readers should not act upon information presented without individual professional consultation.

Any federal tax advice contained in this communication (including any attachments): (i) is intended for your use only; (ii) is based on the accuracy and completeness of the facts you have provided us; and (iii) may not be relied upon to avoid penalties.