RubinBrown Sports Betting Index: June 2024 Analysis

RubinBrown Sports Betting Index: June 2024 Analysis

June Sports Betting Index (SBI)

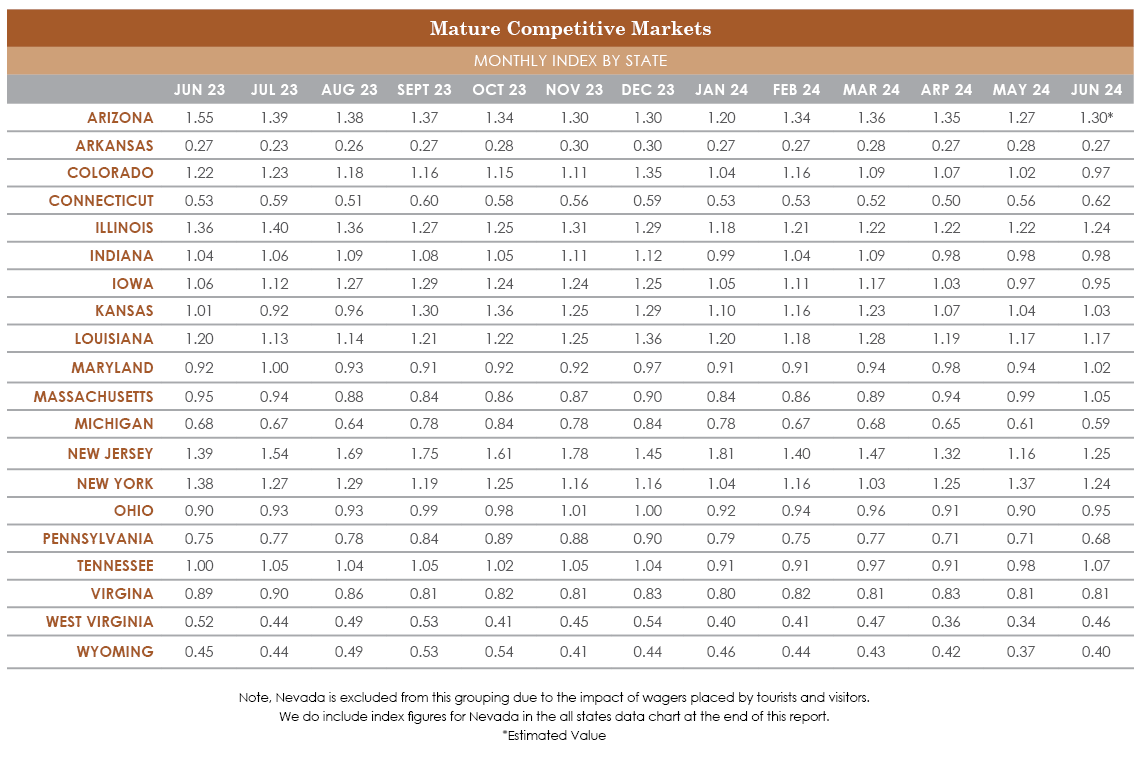

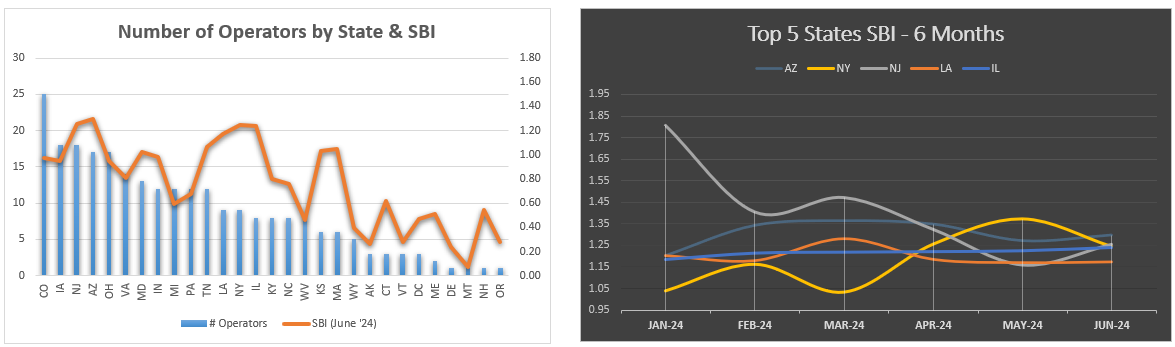

In the chart below, we present our RubinBrown Sports Betting Index (SBI). The SBI is based on our proprietary index of the leading sports betting states in the U.S. To continue to best reflect current market conditions, we’ll occasionally adjust the components of the index. To better compare competitive conditions, our index numbers focus in on a group of mature, competitive states. Therefore, a state with an index score of 1.15 had a raw index score of 15% greater than the average, while a 0.90 index score shows a 10% lower than average result.

LEARN MORE ABOUT THE RUBINBROWN SBI

In our April edition, we predicted a more robust offseason for the sports betting market compared to previous years. Subsequent months have validated this view. June's results reveal an impressive YoY increase of 28% in our baseline raw index score. This leads us to believe that operators have significantly enhanced their offerings, with a focus on high-margin products regardless of the sporting event. For example, Illinois saw 29% of its handle in June attributable to parlay offerings, while over 50% of the wagers placed were parlays. This illustrates most regulated sports betting activity today, lots of smaller wagers with high potential payouts are the preferred choice of patrons.

.png)

Operators also benefited from a robust soccer calendar in June. Both the Euro 2024 tournament, considered the world’s second most prestigious tournament after the World Cup, and the Copa America hosted in the US, offered a greater number of widely followed matches compared to 2023’s Women’s World Cup.

During DraftKings' Q2 earnings presentation, management proposed a surcharge on winning bets in states with high tax rates. This initiative was met with significant backlash and was subsequently withdrawn within two weeks. The proposed surcharge underscores the razor-thin profit margins faced by operators in these jurisdictions and the difficulty in operating a profitable business when facing high taxes on revenues, instead of profits, as is the case for most levied taxes.

As industry attrition and consolidation reduces competition, operators may increasingly look to explore alternative strategies for margin improvement that could test customer loyalty. Such strategies may lead to patrons further exiting regulated offerings for the unregulated offshore world. Regulated operators may quietly prefer such a reshaping of the marketplace with the understandable caveat that they would prefer all participants to place wagers with regulated options and at the terms demanded by those operators.

In our view, this eventual remaking of the operators customer bases and the specific segments they serve, is to be expected of a maturing industry. The optimal strategy for serving the US market is becoming more understood with each passing year. The surprise unlocking of such a huge market in 2018 with the repeal of PASPA and then the subsequent patchwork legalization in the states with different rules and tax rates led to a period of massive opportunity and uncertainty. Countless ideas and strategies have been pursued, with most having been proven to be unprofitable.

However, at its core, sports betting for most patrons remains a leisure activity where patrons expect to pay some amount over time for the entertainment value betting brings them. This ties into the gaming world concept of “lifetime value” of a patron. If holds continue to increase and other methods of raising the cost of this leisure activity are implemented, it doesn’t lead to lifetime value of a given patron increasing. They will become less frequent customers sooner by reducing or eliminating their spending.

Ultimately, implementation of such ideas to increase margins are expected to occur as the industry matures and markets evolve into sustainable levels of competition. As most of the largest sports betting operators are publicly traded companies, they are all under scrutiny as this growth rate begins to level off. While the industry has further room to grow in engaging its current customer base and has some large states still awaiting legalization, the growth rate will inevitably slow as some customers begin to moderate or eliminate participation.

Published: 08/16/2024

Readers should not act upon information presented without individual professional consultation.

Any federal tax advice contained in this communication (including any attachments): (i) is intended for your use only; (ii) is based on the accuracy and completeness of the facts you have provided us; and (iii) may not be relied upon to avoid penalties.