RubinBrown Sports Betting Index: March 2024 Analysis

RubinBrown Sports Betting Index: March 2024 Analysis

March Sports Betting Index (SBI)

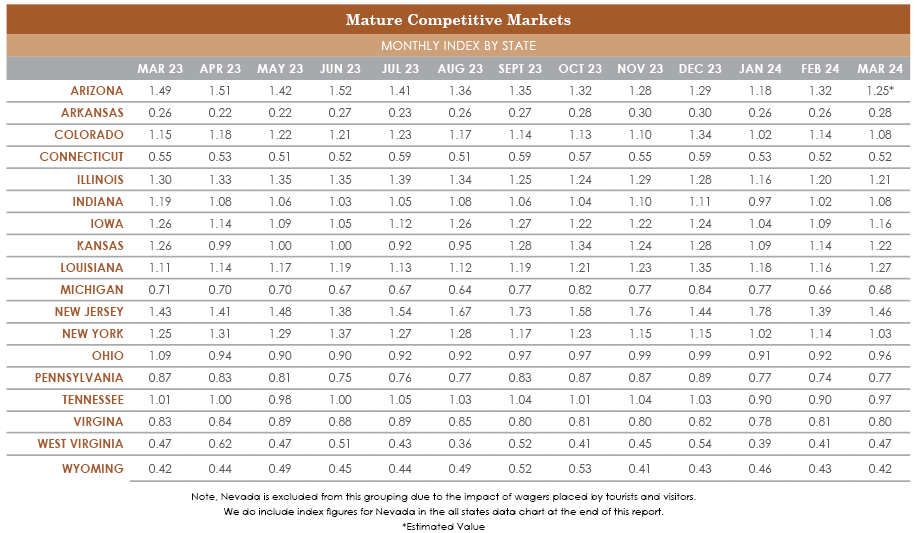

In the chart below, we present our RubinBrown Sports Betting Index (SBI). The SBI is based on our proprietary index of the leading sports betting states in the U.S. To continue to best reflect current market conditions, we’ll occasionally adjust the components of the index. To better compare competitive conditions, our index numbers focus in on a group of mature, competitive states. Therefore, a state with an index score of 1.15 had a raw index score of 15% greater than the average, while a 0.90 index score shows a 10% lower than average result.

LEARN MORE ABOUT THE RUBINBROWN SBI

College basketball was the marquee attraction as sports betting continued its momentum in March. Overall handle of states operating in March of 2023 and 2024 saw a year over year (YoY) increase of 14.8%, with New Jersey making a significant recovery from February’s decline with a $303m/29.6% YoY increase. Partially offsetting growth seen in most markets was a $45m YOY drop in Nevada handle, with February’s hosting of the Super Bowl providing only a temporary respite from the consistent declines that have been occurring since peak levels were achieved in late 2021/early 2022.

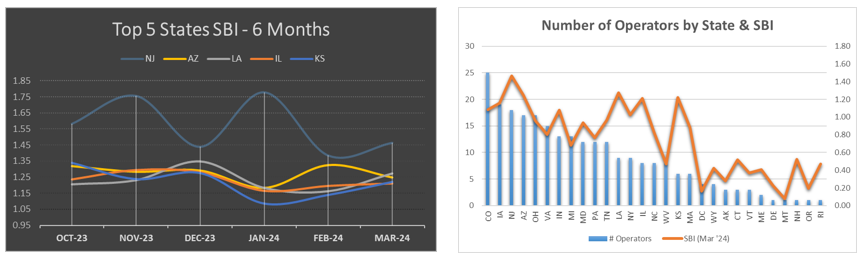

Our proprietary Sports Betting Index (SBI), which is a relative measure of a state’s performance, showed the overall market maintaining momentum through March with the usual suspects of New Jersey, Illinois, and Louisiana scoring well. A surprising stalwart near the top of the rankings continues to be Kansas, which scored a 1.22 index for the month despite the Chiefs Super Bowl run culminating in February. Also adding to the overall market strength is the unprecedented interest in women’s basketball. While hard to discern from reported data, we are fairly certain that record TV ratings and heightened interest in women’s basketball was a contributing factor in what was a very solid month of results for sports betting.

.png)

Though we anticipate a seasonal slowdown in sports betting activity until the return of football in September, there are indications operators may show better than expected results. BetMGM stated they anticipate a stronger baseball season, citing their incorporation of the Angstrom product that they acquired in October 2023. FanDuel also reported a significant increase in handle during the initial weeks of the MLB season due to an improved Same Game Parlay product. The continued evolution of sports betting products towards higher-margin options reflects consumer preferences for low-risk/high-reward wagers which generate higher hold rates for operators.

Despite market wide growth over the past three years, the addition of new states to the sports betting arena has slowed with no additional states expected to open during the rest of 2024. We have also seen continued attrition as more operators pull the plug on some markets, usually citing an inability to achieve scale and lower than expected profit margins in a wildly competitive market. This is most notable for international stalwarts such as Unibet and 888 who have shuttered their U.S. operations after struggling to translate their offerings to appeal to American players.

Most recently, Prophet Exchange announced they will be closing their doors in New Jersey. Prophet has announced that they will be transitioning to a sweepstakes model instead of an exchange model. This follows last month’s announcement by NoVig, an exchange operator in Colorado, of a temporary shutdown as they make changes to their offerings. New Jersey regularly generates the 2nd largest sports betting handle in the country. The departure of the longest tenured exchange might indicate that a single state exchange model is not viable. If a critical mass of liquidity is not attainable in New Jersey, then the odds of a successful single state exchange wagering platform are slim.

March also welcomed North Carolina into the legalized sports betting universe. North Carolina is a college basketball haven with 18 universities that compete at the Division I level. The eight inaugural operators in the Tar Heel state were eager to gain a foothold and provided over $200 million in promotional bets out of a total handle of just over $657 million. This 30.83% promo bet is now becoming a typical practice in new states and we expect another month or two of diminishing levels of promos before the market likely settles in at the 1.5--4% range for the long term.

One noteworthy aspect of this initial period is Caesars Sportsbook's performance. According to CEO Tom Reeg, Caesars captured approximately 9% market share in North Carolina – a significant achievement compared to their performance in other states. Caesars operates two retail sportsbooks at the state’s lone casinos. This has fostered brand awareness and afforded them a brief head start in online operations. As the online sports betting market in North Carolina matures, it will be interesting to observe whether Caesars can maintain its strong position, proving out to a degree the value of tying land-based visibility to online platforms.

.png)

Published: 05/22/2024

Readers should not act upon information presented without individual professional consultation.

Any federal tax advice contained in this communication (including any attachments): (i) is intended for your use only; (ii) is based on the accuracy and completeness of the facts you have provided us; and (iii) may not be relied upon to avoid penalties.