RubinBrown Sports Betting Index: May 2024 Analysis

RubinBrown Sports Betting Index: May 2024 Analysis

LEARN MORE ABOUT THE RUBINBROWN SBI

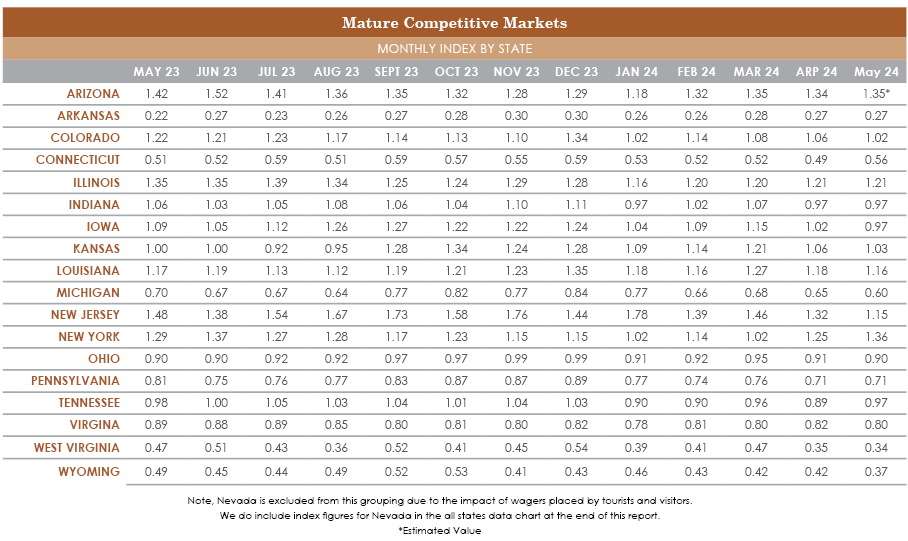

May sports betting saw a continuation of the recent trends where we have lower seasonal handle through 16 of our 18 mature competitive states, but substantial increases from year-over-year comparisons. These increases are increasingly concentrated in the top few operators.

We have also witnessed more operators exiting some or all US markets in which they had planted their flags. Betway has decided to cease operations in the US sports betting market. They have operations in 9 states and including sponsorship agreements with multiple sports teams. They do appear likely to continue with online casino operations in 2 states. In Arizona, SaharaBets has also decided to cut their losses and shutter operations, which may have been coming in any event due to the sale of the Arizona Coyotes which entitled them to a sports betting license.

These exits come as little surprise as we have spoken on the inevitable attrition and consolidation of the industry through market exits and M&A activity. We expect this trend to persist in the attrition phase as most successful markets look like they can only healthily support 8 to 10 operators, especially at the higher tax rates that have been recently proposed or approved. Once markets get closer to sustainable levels, the trend towards M&A will likely pick up in interest.Florida sports betting has been a recent industry focal point. The state granted a 30 year exclusive gaming compact and sports betting monopoly to the Seminole Tribe, allowing them to operate sports betting on the Hard Rock mobile app throughout the state. So the question becomes, will Florida realize its potential market size for legalized sports betting with just one operator?

The Florida Sports Betting market has the potential be the largest market in the country based on its population. With over 22 million residents, it is 12% more populous than New York, the current largest sports betting market. With multiple franchises in all the major professional sports leagues, as well as highly supported college teams and high profile offerings in golf, tennis, and racing, Florida serves as an ideal market for sports betting operators.

Utilizing our proprietary methodology, we conservatively estimate that, upon maturity, the Florida sports betting market could be upwards of $23 billion in annual handle, and well over $2 billion in operator revenue, if it were to become a competitive market with multiple operators. For reference, New York’s trailing twelve month handle is $20.8 billion. However, the absence of multiple operators in Florida would likely result in lower realized handle and revenue compared to these projections.

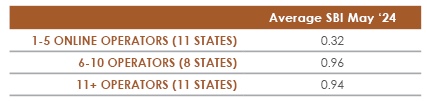

The RubinBrown Sports Betting Index has shown that a competitive market with multiple operators will outperform a market with limited options. We have found our index numbers for markets with limited options to be as low as one-third of those states with competitive markets.

Additionally, our data also shows that there may be an optimal number of operators within a single state market. We found no noticeable increase in SBI results after a market reaches up to 10 operators. While the states may benefit from increased licensing fees, from a consumer perspective, there looks to be little advantage to market oversaturation.

Published: 07/22/2024

Readers should not act upon information presented without individual professional consultation.

Any federal tax advice contained in this communication (including any attachments): (i) is intended for your use only; (ii) is based on the accuracy and completeness of the facts you have provided us; and (iii) may not be relied upon to avoid penalties.