RubinBrown Sports Betting Index: November 2023 Analysis

RubinBrown Sports Betting Index: November 2023 Analysis

November Sports Betting Index (SBI)

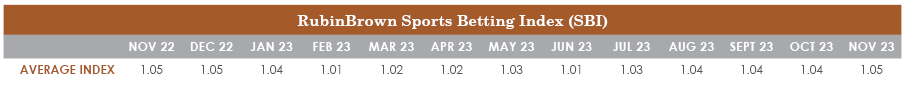

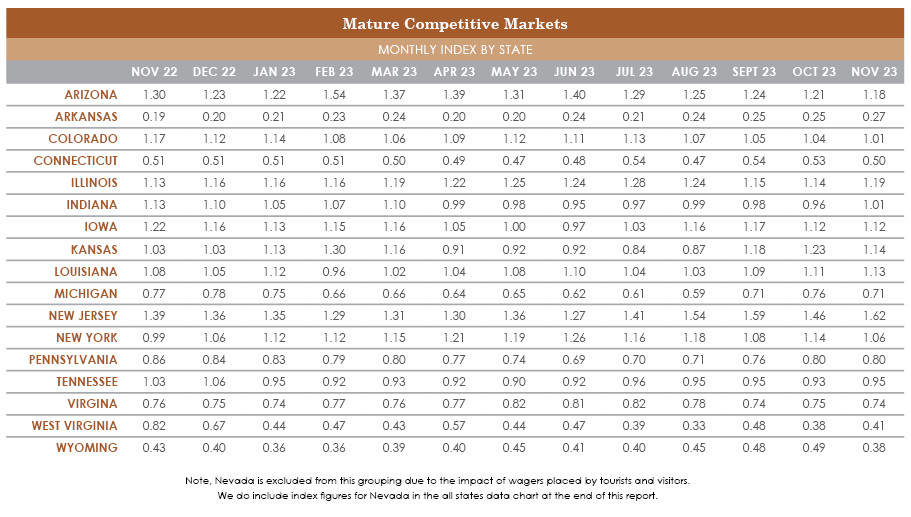

In the chart below, we present our RubinBrown Sports Betting Index (SBI). The SBI is based on our proprietary index of the leading sports betting states in the U.S. To continue to best reflect current market conditions, we’ll occasionally adjust the components of the index. To better compare competitive conditions, our index numbers focus in on a group of mature, competitive states. Therefore, a state with an index score of 1.15 had a raw index score of 15% greater than the average, while a 0.90 index score shows a 10% lower than average result.

LEARN MORE ABOUT THE RUBINBROWN SBI

With the eyes of the sports world about to turn its gaze onto Las Vegas for the upcoming Super Bowl, we use our SBI to take a closer look at the state of sports betting in Nevada. The Silver State is an outlier in our index. This outlier status is driven by a level of tourist participation and tourism arrivals in Las Vegas, including those who are visiting for sporting events, have been near record levels. The Las Vegas Strip had record gaming revenue in 2023 at $8.9 billion, up 7.4% ($613 million) from 2022.

Looking at just sports betting handle however, we find that after peaking in May 2022, handle in Nevada has been steadily declining. This decline has hardly been noticed or mentioned because few are as focused on handle as we are. Revenue in Nevada has grown slightly despite the lower handle as hold percentages have been increasing. The SBI shows a drastic decline over the last 12 months as the November 2023 Index of 3.69 represents a 22% drop compared to the November 2022 Index of 4.69.

Even more concerning, the first three months of this NFL season have not been a panacea for Nevada’s sports betting industry. Despite the anticipation for hosting the Super Bowl and having more leisure visitors to Las Vegas than ever, the index has remained under 4.00 since July. One would think more awareness around sports betting with it mentioned prominently in all sports broadcasts and feeder markets providing more seasoned sports bettors thanks to the 37 other states where it is now legal may have started a bit of a fall resurgence. And yet, Nevada handle over the first three months of football season is down 2%.

The many reasons why handle is declining while hold is increasing can be speculated on by others. For those concerned about sports betting and the growth of this industry, seeing sports betting activity in Nevada declining during times of record levels of gaming revenue and a number of positive drivers is not something to overlook. Revenues may continue to increase for a time with higher hold keeping observers from noticing the issue. Ultimately, the dollars patrons place in their bets is the main driver of long-term growth because operators can only pull the levers of higher-hold offerings for a limited time.

.png)

Sports betting is here to stay and will always have its regulars to generate revenue but the same could be said about horse racing or poker. Let’s hope Nevada’s recent handle trends don’t start showing up in other key markets.

Published: 02/07/2024

Readers should not act upon information presented without individual professional consultation.

Any federal tax advice contained in this communication (including any attachments): (i) is intended for your use only; (ii) is based on the accuracy and completeness of the facts you have provided us; and (iii) may not be relied upon to avoid penalties.