RubinBrown Sports Betting Index: September 2024 Analysis

RubinBrown Sports Betting Index: September 2024 Analysis

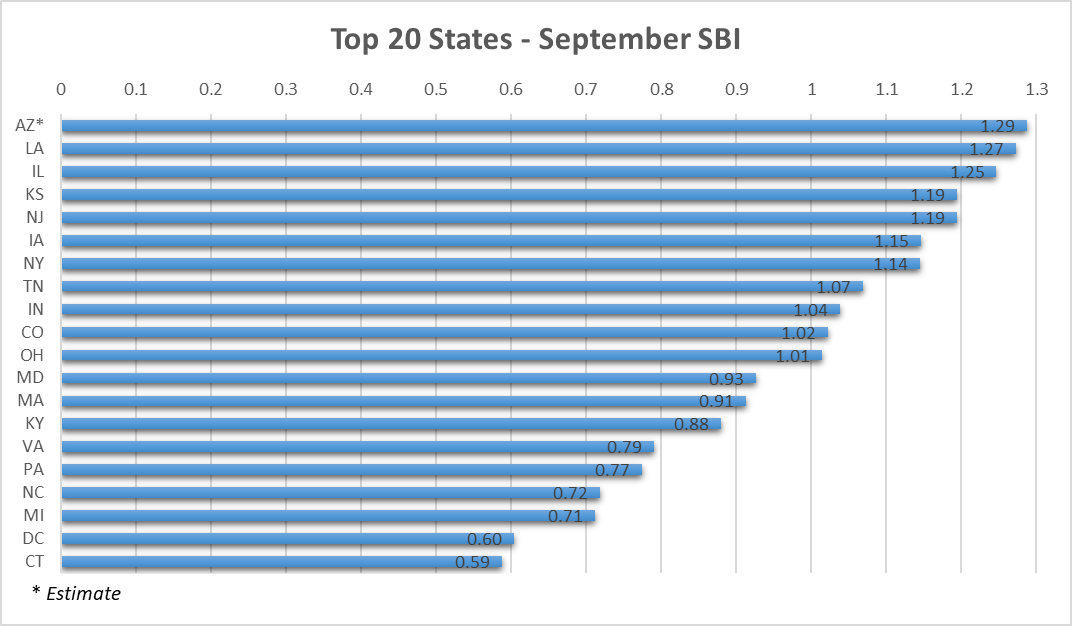

September Sports Betting Index (SBI)

In the chart below, we present our RubinBrown Sports Betting Index (SBI). The SBI is based on our proprietary index of the leading sports betting states in the U.S. To continue to best reflect current market conditions, we’ll occasionally adjust the components of the index. To better compare competitive conditions, our index numbers focus in on a group of mature, competitive states. Therefore, a state with an index score of 1.15 had a raw index score of 15% greater than the average, while a 0.90 index score shows a 10% lower than average result.

LEARN MORE ABOUT THE RUBINBROWN SBI

September also brought what the industry likes to refer to as “friendly outcomes” as hold percentages for the month breached the 10% threshold in 27 of our reported markets (Arizona has yet to report and Tennessee does not report hold percent). To the delight of the bookmakers, even Nevada, with its more traditional skew of single-game bets, hold exceeded 10% for the first time since 2020.

Earnings Season

During the recent Flutter Q3 earnings call, management noted that the NFL season contributed significantly to growth, with handle up 36% along with a 10% increase in customer acquisition, and that the US saw a 28% YoY increase in Average Monthly Players (AMPs) to 3.2 million. This increased level of customer participation has translated into “peak wagers per minute already higher than Super Bowl LVII.”

In last month’s analysis, we questioned whether high-hold parlay products could maintain a customer base that spent more over time. With increased customer losses in September, FanDuel softened the impact and increased promotional expenses. These promotional expenses climbed to 540 basis points during the quarter, above their stated 400 basis point guidance. Flutter communicated in their call, ”As margins increase, we naturally spend more on generosity proportions offered to customers”.

Offering higher promotions to maintain player engagement in periods of player losses will be put to the test in Q4 as preliminary October numbers show that players have rebounded nicely in the following month. We will have to wait for the full October reporting before we can evaluate how nimble sports books will be in pivoting their “generosity” from high-hold months to low-hold ones.

DraftKings reported that its Average Monthly Unique Player (MUPs) increased 56% to 3.6 million. Excluding Jackpocket users, MUPs would have been 2.9 million, a 27% increase. Average revenue per MUP (ARPMUP) excluding Jackpocket-only users was $122, representing an 8% YoY increase. DraftKings also mentioned that it is closely following election market activity and may look to offer such options in the next election season, should it find regulatory acceptance.

While the top line and profitability numbers consistently draw attention for their growth and strong results for the two biggest operators, RubinBrown continues to focus on the underlying data, most notably the user counts. Interestingly, these two market leaders have a combined 6 million users, although there is overlap as some users patronize both sites. The AGA reported that 39 million adults claimed to have placed a sports wager in the last year. About 10-15% of those adults placing wagers were active users at the two largest sports betting operators at the end of September, which is close to the peak period for sports betting activity. While this may point to future upside for both operators, especially if new state markets open up to online sports betting, it also indicates that the market remains diverse and perhaps not as concentrated in just two operators as one might think.

Welcome, Missouri!

Speaking of new markets, 2024’s first new approved market has emerged as Missouri voters narrowly approved the go-ahead for legalized online sports wagers. Missouri’s population is concentrated in the St. Louis area to the east, and the Kansas City area to the west. It will be interesting to see how much revenue the border states of Illinois and Kansas cede to their newly legalized counterpart. According to the RubinBrown Sports Betting Index, Illinois and Kansas have outperformed most states with a trailing twelve-month average Index number of 1.25 (Illinois) and 1.16 (Kansas) respectively. Launch is expected in mid-2025 (but is required no later than December 2025).

We expect a quick ramp period due to existing Missouri patrons being in the databases of operators in bordering states and their likely overall familiarity with sports betting options from these existing offerings. Over time, Missouri is likely to generate sports betting revenue in line with states such as Colorado, Indiana, and Maryland due to its population of 6.2m (18th largest in the US) and having teams in all major professional sports leagues.

RubinBrown is working on analyzing the potential market shifts from this coming launch and is eagerly anticipating the addition of sports betting to the state of Missouri. Please contact us for more of our analyses and to learn more about how we can help sports betting operators enter new markets.

Published: 11/25/2024

Readers should not act upon information presented without individual professional consultation.

Any federal tax advice contained in this communication (including any attachments): (i) is intended for your use only; (ii) is based on the accuracy and completeness of the facts you have provided us; and (iii) may not be relied upon to avoid penalties.